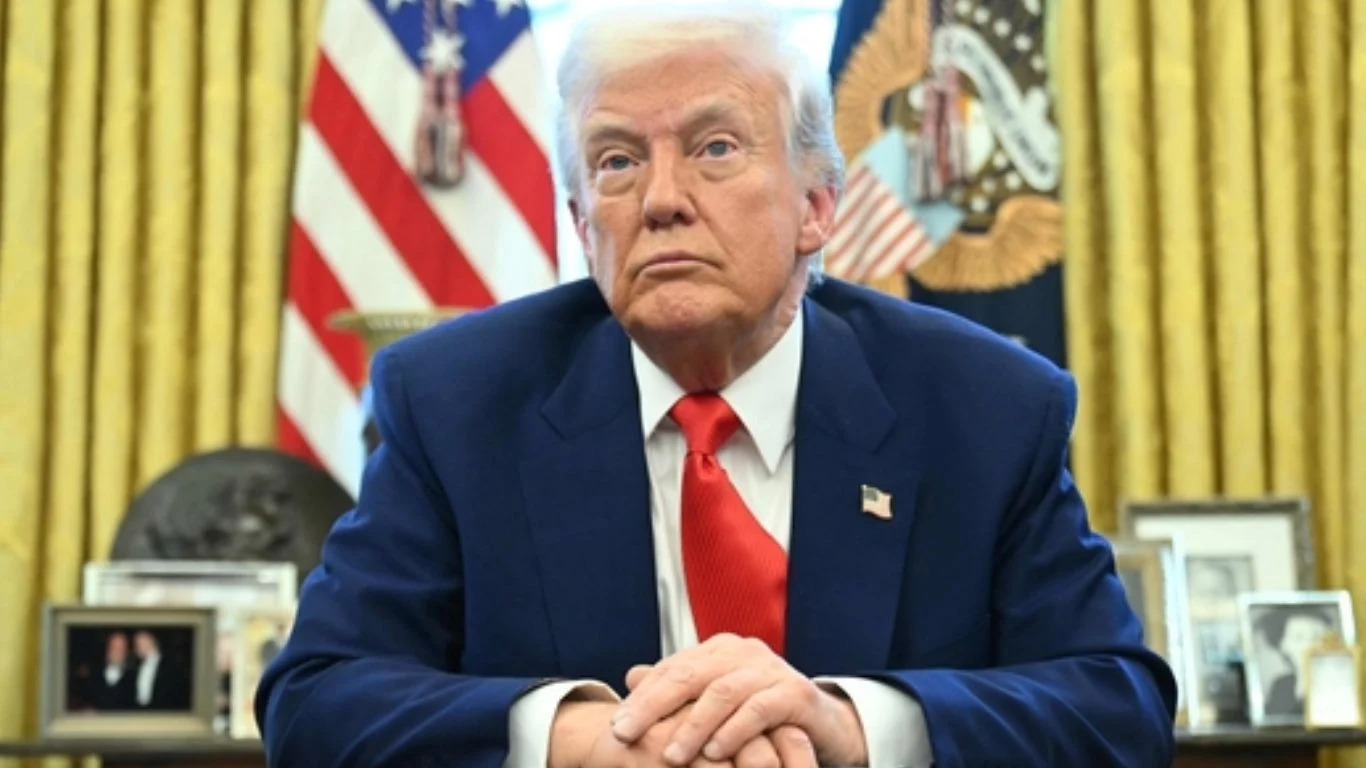

Trump Administration Slaps Up to 245% Tariffs on Chinese Imports, Escalating US-China Trade War

In a dramatic escalation of the ongoing trade tensions between the United States and China, former President Donald Trump’s administration has announced sweeping new tariffs of up to 245% on Chinese imports. The move, revealed in a White House fact sheet late Tuesday, is being positioned as a direct response to Beijing’s recent export restrictions and retaliatory tariff hikes, which Washington claims are aimed at undermining critical U.S. industries and national security.

A Sharp Response to China’s Export Curbs

According to the White House statement, the new tariff structure comes in retaliation for what the administration described as “coordinated and strategic export bans” imposed by China on vital high-tech materials. These include gallium, germanium, and antimony—elements crucial for the defense, aerospace, electric vehicle, and semiconductor sectors.

The U.S. also cited China’s recent suspension of exports of six heavy rare earth metals and rare earth magnets—materials central to a wide range of advanced technologies—as a major provocation. The statement warned that Beijing’s actions appear designed to “choke off” global supply chains in an effort to exert geopolitical pressure.

“These measures are not just economic—they are strategic,” the White House added. “By denying access to materials essential for automakers, semiconductor companies, military contractors, and aerospace manufacturers, China is attempting to manipulate global trade in its favor.”

Tit-for-Tat: A Cycle of Retaliation

The newly imposed U.S. tariffs are part of a deepening tit-for-tat battle. Last week, China raised tariffs on American goods to 125%, a sharp response to Trump’s earlier decision to increase tariffs on Chinese imports to 145%. That move, announced alongside a 90-day pause on additional tariffs for other countries, was intended to single out Beijing for what the administration calls “non-reciprocal trade practices.”

Economic and Strategic Implications

Trade experts and economists are closely watching the unfolding situation, as the new 245% tariffs could have far-reaching implications not just for U.S.-China relations, but for global markets as well.

“This is the highest tariff rate we’ve seen on China to date,” said Michael Henderson, a trade policy analyst at the Peterson Institute for International Economics. “It’s a significant escalation, and while it’s clearly aimed at pressuring China, the ripple effects could be enormous—impacting everything from consumer electronics to electric vehicles.”

Industries that rely heavily on components from China, especially in sectors like renewable energy, consumer electronics, automotive manufacturing, and aerospace, could face rising costs and disruptions. There’s also concern about inflationary pressures, as tariffs often lead to higher prices for end consumers.

Nevertheless, the Trump administration maintains that the tariffs are a necessary cost to restore fair trade and to reduce long-standing imbalances between the two economic superpowers.

“We are no longer in the era of one-sided trade,” a senior administration official told reporters. “This administration is committed to ensuring that American workers, industries, and companies are no longer undercut by unfair competition, intellectual property theft, and supply chain manipulation.”

China’s Strategic Moves

In recent months, China has employed a more assertive trade stance, particularly in response to growing geopolitical tensions. The country’s decision to restrict exports of gallium and germanium—materials used in everything from military radar systems to smartphones—was viewed by many analysts as a calculated step to assert leverage in an increasingly competitive global tech race.

Beijing’s suspension of heavy rare earth metal exports this week only heightened fears of further decoupling between the world’s two largest economies. Rare earths are essential in the production of electric vehicles, wind turbines, and defense technologies, and China currently controls a dominant share of their global supply.

“China is not just responding—it’s playing its own long-term game,” said Dr. Anika Shah, a geopolitical analyst at the Atlantic Council. “By using its control over these critical materials, it is testing how far the U.S. and its allies are willing to go in this economic standoff.”

International Reactions and Future Outlook

International responses have been cautious but concerned. European and Asian trade partners are watching the escalation closely, with many nations seeking to avoid being caught in the crossfire while simultaneously exploring trade realignments to ensure supply chain stability.

“Every country will be treated individually,” the White House said. “Those that are willing to engage in fair and reciprocal trade will benefit from lower tariffs and improved market access.”

As for China, experts predict that Beijing may respond further in the coming weeks, either through additional trade barriers, restrictions on foreign firms operating in China, or currency measures. Both nations now find themselves locked in an increasingly high-stakes battle that extends well beyond traditional trade disputes.

For American consumers, businesses, and investors, the consequences of this latest tariff hike remain to be seen. But what is clear is that the U.S.-China trade war has entered a new phase—one that is fiercer, more complex, and potentially more disruptive than ever before.